|

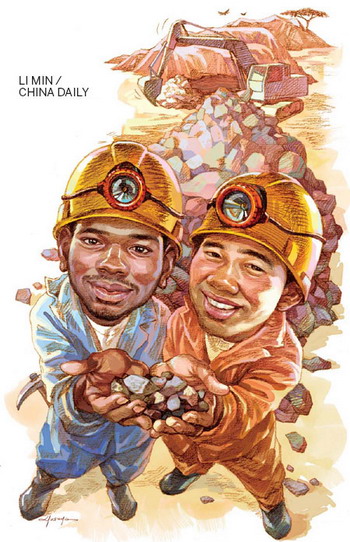

Chinese investment in African mining industry comes in different forms and is crucial for both

The relative slowdown in China's economy was one of a number of factors casting a shadow over the recent Mining Indaba Conference in Cape Town. The mining sector in South Africa has other problems closer to home, including labor unrest and the threat of increasing government regulation.

But the demand for resources from the world's second-largest economy - as for the rest of the continent - remains an important lifeline for the mining industry.

The sector has been hit hard by the global financial crisis, and the Johannesburg Stock Exchange remains highly sensitive to economic data coming from China.

Last year was particularly bad for the iron ore industry, with prices slumping to a three-year low in September to $88 a ton on fears about China's recovery.

China, the world's largest consumer of steel, is the destination for half of the world's iron ore exports.

Chinese investments still continue to be made, however. It was announced in February that a Chinese consortium, headed by the Chinese mining group Jinchuan, is taking a 45 percent stake in South Africa's Wesizwe Platinum. It is the first Chinese investment in the platinum sector and about $650 million of the capital is being provided by China Development Bank.

China's Hanlong Group is also set to complete a $1.45 billion takeover of Sundance Resources, the Australian company that owns important West African iron ore supplies, including the Mbalam mine straddling Cameroon and the Republic of Congo.

Another major Chinese acquisition could have been African Barrick Gold, Tanzania's largest gold mining concern, had talks between China National Gold Corporation and Canadian Barrick Gold Corporation over a $3.9 billion deal not collapsed in January.

David Humphreys, principal at DaiEcon Advisors, a London-based consultancy specializing in the mining industry and one of the keynote speakers at Indaba, says the mining industry, particularly in Africa, has become obsessed with China.

"As a result any suggestion that China will slow down sends shockwaves through the thinking of the industry," he says.

He says the big fear is that China will follow the same path as Japan whose huge appetite for resources in the 1960s and 1970s leveled off and has been on a plateau since.

"That is where a lot of the debate is now focused, whether China will follow Japan or whether it is a false analogy. The difference could turn on just a small percentage either way."

Michael Power, investment strategist at Investec Asset Management, says putting the blame on China for any fall in commodity prices is perverse.

"The reason why prices have fallen across a range of commodities is that demand in the West has collapsed. You watch CNBC and Bloomberg and they have a hissy fit when China's growth rate is 0.1 or 0.2 points down, but it doesn't tell you what was going on in dollar terms."

Power, a veteran of the African mining scene who was speaking from his huge flat in central Cape Town bedecked with African artifacts, says many observers do not do their sums.

"People don't understand the mathematical mechanics of compound interest. China's growth might have slowed slightly but the base is huge. Last year China added another Australia to its GDP, by 2018 this will be another Germany and by 2021, another Japan and that will be every year. The volume demand for resources will not decline," he says.

Year's first rainfall for Beijing

Year's first rainfall for Beijing

![]()